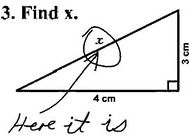

The "Throw Momma from the Train" tax provision

Now the U.S. Congress has granted us a social scientist's fondest dream—or worst nightmare—the perfect "natural experiment." As of January 1 of this year, the U.S. estate tax has been abolished for the year 2010, and is scheduled to be reinstated in 2011 with rates as high as 55%.

If our findings (and those of our colleagues in Australia and Sweden) are right, some [deaths] would be "moved" from the end of 2009 to the beginning of 2010, as some rich folks hold on to bequeath their assets tax-free.

Of course, the really morbid stuff will happen at the end of this year, when dying in December of 2010 will incur no estate tax, but dying beginning in January 1, 2011 can trigger a tax liability equal to more than half the taxable estate.

It's being called the "Throw Momma from the Train" tax provision.

A few of my daughter

Melina's great posts:

A few of my daughter

Melina's great posts:

0 Comments:

Post a Comment

<< Home